Sales Tax vs Income Tax for Beginners: The Ultimate Guide

Introduction: Why This Guide Is Your Compliance Lifeline

Starting a business is hard. However, tax laws make it much harder. Many beginners ask one key question: What is the real difference between Sales Tax vs Income Tax? Confusing these two tax systems is the most common, and costly, mistake a small business owner makes.

Therefore, this guide will help. One tax is on profit that you pay. Meanwhile, the other is a tax on sales that you collect for the state. This guide is your Survival Guide to clearly split these two rules. Ultimately, it helps you meet all deadlines and avoid huge fines.

The Fundamental Distinction: Sales Tax vs Income Tax

Understanding the Core Difference: Sales Tax vs Income Tax

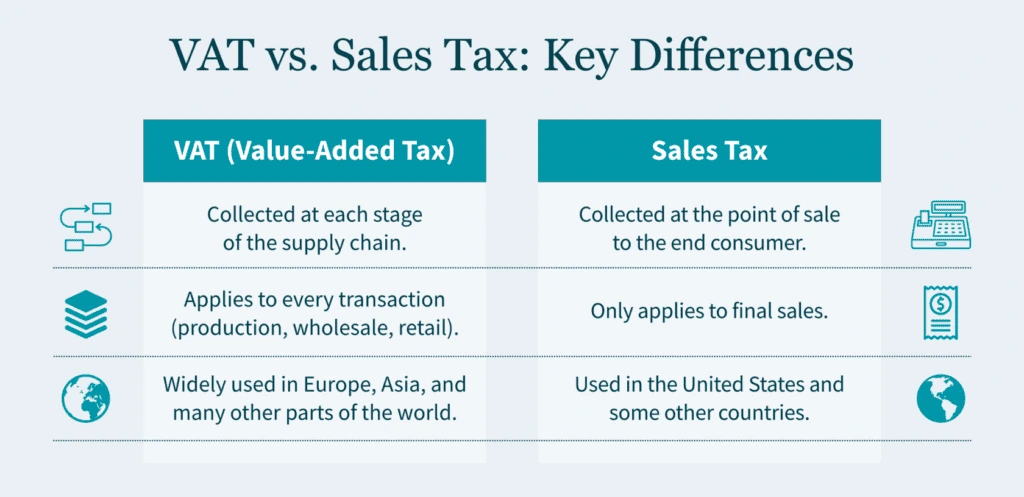

To manage compliance, you must first grasp the purpose behind each tax. Specifically, they are set by different governments and track different financial numbers.

Income Tax: The Direct Tax on Profit Liability

Income Tax is a direct tax. In short, it’s charged by federal and state governments on your net earnings (business profit). Essentially, this is the tax on the money your business keeps.

- Who Pays: The Business Owner directly.

- Authority: Mainly the Internal Revenue Service (IRS).

- Filing Frequency: Generally Once a year. However, you must make mandatory Quarterly Estimated Payments to pay the tax as you earn the income.

Sales Tax: The Pass-Through Tax on Consumer Transactions

Sales Tax is an indirect tax. In contrast, it is charged by state and local governments on the sale of goods. Therefore, your business acts only as a collection agent.

- Who Pays: The End Consumer (your customer).

- Authority: State and Local tax departments.

- Filing Frequency: Typically Monthly or Quarterly, depending on how much you sell.

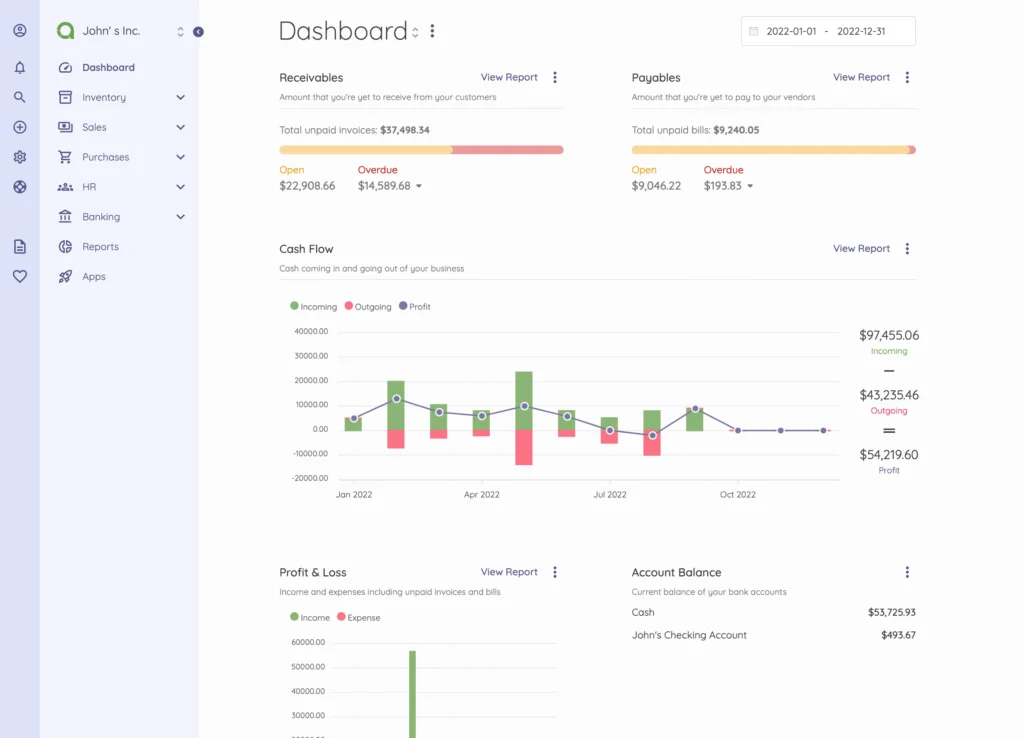

Visualizing Sales Tax vs Income Tax on Financial Statements

The easiest way to see the difference between Sales Tax vs Income Tax is to look at your financial reports. For example, Income Tax relates to your Profit & Loss, but Sales Tax is just a Liability until you send it to the state.

Reporting and Remitting Sales Tax: The Operational Checklist.

Mastering Tax Operations for Sales Tax vs Income Tax

Compliance requires two main tasks. Specifically, you must manage your estimated Income Taxes and correctly handle Sales Tax collection.

Income Tax Compliance: Avoiding Quarterly Estimated Penalties

The most common error for beginners is failing to use the “pay-as-you-go” system for Income Tax. Consequently, this often leads to government penalties.

- The Four Deadlines: Payments are due on April 15, June 15, September 15, and January 15. Therefore, these four dates are critical.

- Safe Harbor Rule: To avoid penalties, you must pay at least 90% of the tax due this year or 100% of the tax shown on last year’s return.

- Record-Keeping: Every business expense you claim must be backed up by a receipt.

Sales Tax Compliance: Navigating the Nexus and Rate Labyrinth

Sales Tax compliance is complex due to state-by-state laws. In fact, this is much harder than filing Income Tax for many sellers.

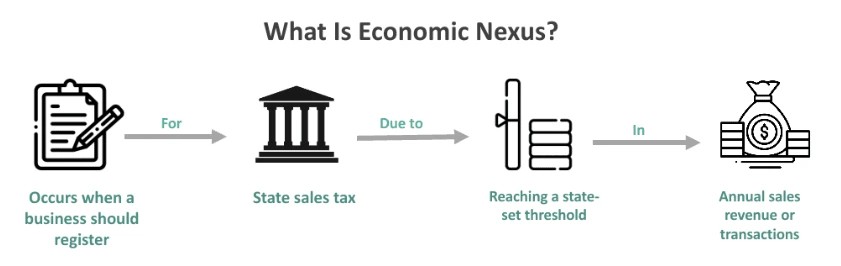

- Establishing Nexus (Where to Collect) You only collect sales tax where you have Nexus—a “link.” This rule sets your legal duty to a state.

- Physical Nexus: This means having a physical site, for example, an office or employee there.

- Economic Nexus: This means you have high sales volume. If your revenue or sales count into that state is too high (like $100,000 in sales), you must sign up. Therefore, check a definitive state tax resource or tax software guide detailing Economic Nexus thresholds for state limits.

- Managing Exemptions (The Resale Certificate) If you sell goods for resale, the sale is tax-free. However, you must get a valid Resale Certificate from the buyer. Critically, without this paper, you are liable for the unpaid tax if audited.

Audit Strategy: Preparing and Protecting Your Business Records.

The Audit-Proof Strategy: Sales Tax vs Income Tax

True compliance isn’t just about filing forms. Instead, it’s about setting up systems that stop errors. Consequently, this smart plan lessens the stress of managing both Sales Tax vs Income Tax.

Building an Audit-Proof System for Both Tax Types

To pass an audit with ease, you must use strong controls and keep great records.

- Separation is Mandatory: Never mix personal and business money. Therefore, use clear business accounts for all funds.

- Quarterly Reconciliation: Every three months, check that the Sales Tax you took in matches the amount you sent. Furthermore, check that your Income Tax deductions are backed by documents.

- Long-Term Retention: Keep all tax records for at least seven years. Consult official IRS record retention requirements for rules. Overall, this check is key for a strong Audit-Proof System.

Technology as Your Compliance Solution

Doing this by hand is risky and leads to errors. Therefore, smart software simplifies both forms of tax.

- Income Tax Automation: Use accounting software to sort money flows and make simple reports for estimated tax.

- Sales Tax Automation: Use specialized sales tax software to track nexus and set the right rates fast.

Conclusion: Your Tax Confidence Starts Now

From Confusion to Control: Your Next Step in Compliance

The critical difference between Sales Tax vs Income Tax is simple: one taxes profit (paid by you), and the other taxes sales (collected by you).

By following these rules, you move from feeling anxious to feeling fully in control.

Now that you have the ultimate guide to understanding these two core tax pillars, what is the very first step you plan to take to audit-proof your business today?